Daraz is one of the most popular e-commerce sites in Nepal, and it has been trying its best to stand out among Nepal’s e-commerce by providing good value to the customer and making the transaction easy. To continue the flexibility in e-shopping, Daraz has now introduced a new plan – 0% EMI (Equated Monthly Installments).

What is 0% EMI?

0% EMI is also known as no-cost EMI (Equated Monthly Installments). In the scheme, you can purchase goods of a certain amount by making an equal monthly payment of the total product cost over the predefined period. The monthly payment does not add any interest or down payment.

A paradigm for 0% EMI is, buy a product that costs Rs. 16,000 at four months of 0% EMI, you could then pay Rs. 4,000 each month for four months. By the end of the four months, you would have paid the total cost, i.e., Rs. 16,000.

Daraz 0% EMI

Daraz 0% EMI is a service that lets the customer purchase items through a deferred payment plan using their credit card from the partnered bank.

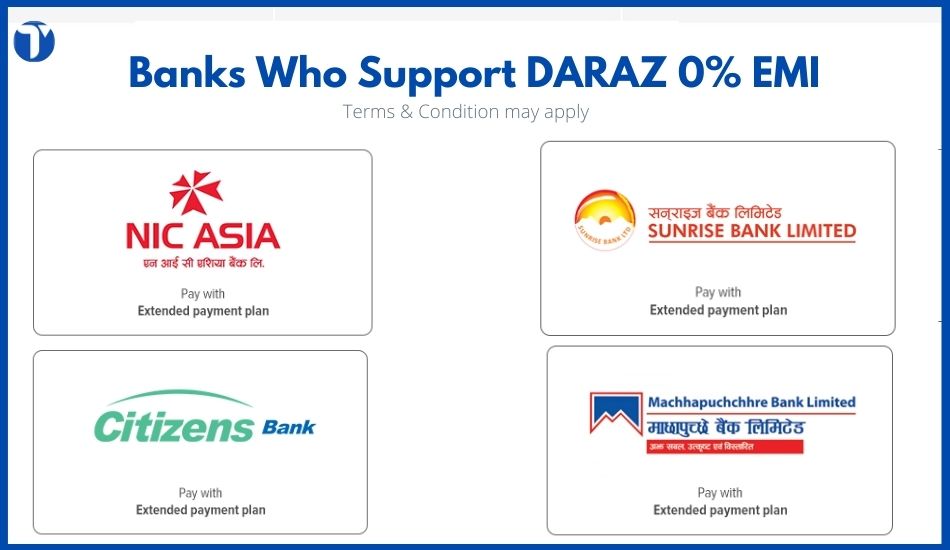

For the scheme, you should have the credit card of the partnered bank. Until the date, NIC Asia Bank, Sunrise Bank, Machhapuchhre Bank, and Citizens Bank are the partnered banks. Since there is no hidden cost for EMI, you may have to pay the bank for the credit card issuance as per the bank’s rule.

The full outstanding balance will be blocked on your credit card, released only after the monthly installments. You can also see the blocked amount in the bank statement.

How to make EMI Transaction in Daraz?

- Visit Daraz app

- Choose your product and add it to the cart

- Confirm your order by clicking on checkout and choose the Pay by credit card option

- After the payment is made, contact your bank and request to convert your payment to a 0% EMI plan.

Once you request the concerned bank to convert your payment to 0% EMI, it takes up to seven working days for the installment to be seen on your credit card statement.

If you return, you get your money back, and the transaction will also be reversed on your credit card within ten working days. On the other hand, charges of reversal may vary as per the rules of the bank. You should also notify the bank about the cancellation of the purchase or EMI.

What are the criteria for EMI transactions in Daraz?

For the EMI transaction or approval, ensure the following:

- Your minimum checkout value must be NPR 15,000, while if you have a credit card from Citizen Bank, your minimum value is NPR 10,000.

- The cart’s product should be only one during the checkout, and the total cart value should either less than or equal the credit limit available on your credit card.

- 0% EMI is applicable on a single product, not on the total cart value.

- You should inform the respective bank within 15 days of making the payment of the product.

For NIC Asia customers, you can fill the EMI application. - Banks will not be liable to make EMI transactions if your credit card has an existing EMI plan, which means you can only make a new Daraz EMI plan only after you have no current EMI plan or have cleared your existing EMI plan.

In case of the failure on the monthly installment, the bank will charge a late fee as per their policy.

The minimum purchase amount, tenure, and maximum capacity of the bank vary from one another. Please have a look at their policy below.

| Bank | Tenure | Min. Purchase | Max. Cap |

| NIC Asia | 3 months | NPR 15,000 | 1,40,000 |

| Sunrise Bank Limited | 3 months / 6 months | NPR 15,000 | Approved Limit |

| Citizens Bank | 3 months / 6months | NPR 10,000 | Approved Limit |

| Machhapuchhre Bank Limited | 3 months / 6months | NPR 15,000 | Approved Limit |